For Brokerage Profits, Syndication is an Inefficient Stepchild to IDX

(Note: This post is about industry-wide brokerage profitability in an IDX scenario vs a syndication scenario. It’s not about an individual broker’s profits or decision to use IDX/syndication.)

(Note: This post is about industry-wide brokerage profitability in an IDX scenario vs a syndication scenario. It’s not about an individual broker’s profits or decision to use IDX/syndication.)

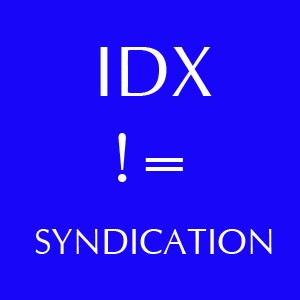

We’re hearing more often that IDX and listing syndication are essentially the same (via Rob). From a consumer advertising perspective, that argument may make sense. From a broker-centric profit mindset, it’s far from the truth.

Our company shares our listings with brokers via IDX and with portals via syndication. It makes sense based on our clients’ requests, but to claim the two are the same is to ignore the money.

5 million homes will be sold this year, no matter which websites exist today or tomorrow. That’s a fairly finite commission base. How that commission pie gets split up has everything to do with who does the customer acquisition through lead generation. There is a strategic advantage for brokers in promoting IDX vs. syndication.

IDX is about efficiency of doing business within the broker sphere. It uses the cooperative power of brokers and agents across corporate borders to keep the rewards of property marketing and client acquisition within that sphere.

With IDX, the winners are always brokers. Broker #1 makes a commission when his listing is advertised via IDX and sold. Broker #2 creates profits by generating IDX leads, and either having her agents represent the buyers or referring them to Broker #3. Broker #3’s agent represents the buyer, earns a commission, and pays Broker #2 a referral fee. The commissions are all going to brokers, and they’re either taking home paychecks, or reinvesting them in the brokerages. Agents are at least just as well off as they were before, if not better, when their brokers are making money.

Syndication brings a new entrant into the “who’s getting paid” category. The advertising portal is now taking the profits from the generation of the lead. Broker #1 lists the property and makes a commission on the sale. Broker #2 doesn’t generate income in this scenario. Broker #3 pays the lead acquisition fee to the advertising portal, instead of to a broker.

In both scenarios, a seller’s home was sold, and a buyer got the home–the fulfillment of the brokers’ duties. The amount of money earned by all brokers combined in the syndication scenario is significantly less, though. There are only two commissions being paid on the transaction. When they’re always split up between brokers, the broker sphere becomes stronger. Any portion which goes outside the broker sphere makes brokers overall less profitable.

(Follow-up: The costs for better websites and more traffic are important, but a separate discussion. Brokers don’t need to generate 100 million leads/year like the portals. They just need to make the homes available, and they’ll sell. Which broker gets a larger share is, again, a separate discussion.)

This isn’t an argument for ending syndication. It’s a greedy, profit-driven analysis of what kind of advertising will keep more money in the broker sphere’s pockets. Nor is it all-encompassing. There are website vendor fees (minimal compared to syndicated lead costs), premium advertising fees (a separate discussion from model efficiency), etc. that can come into play. Still, the conclusion seems obvious.

Syndication is a valuable outlet for many brokers, but it’s not the same as IDX. Brokers can have substantive reasons to support the use of one and not the other.

IDX creates efficiency for the brokerage sphere, which increases financial profitability for the group as a whole. Syndication is a less-efficient platform in terms of overall brokerage profits. Real estate is, on an annual basis, similar to a zero-sum game. There are only so many transactions, and commissions, that will occur based on the market. Broker financial profitability is dependent on brokers earning as large a portion of that commission pool as possible.

Bryn Kaufman

Posted at 18:58h, 14 AprilSam, good points!

My MLS provides Zillow an IDX feed, with the addition of a roster of all agents. I guess you could call it IDX+, or Syndication, but from a technical stand point, it is really the same as an IDX feed.

From a profit stand point, I would prefer that our MLS not provide an IDX feed to Zillow.

I have a number of tough competitors. We have one agency who gives 100% of their commission back to buyers, we have Red Fin, and we have Zillow who can afford to lose over $40 million last year and still spend billions to buy another money losing competitor.

It is not easy to run a small team who needs to be profitable every year to compete with these well funded, money losing ventures.

Sam DeBord

Posted at 06:46h, 15 AprilBryn, I’m all for brokers being able to make that decision. MLSs need to provide an opting mechanism if they’re going to establish feeds.

You make a very interesting point about industry priorities, when you’re competing with, and aiding “well funded, money losing ventures.” Wearing the broker and agent hat at the same time makes for some situations in our industry that must look bizarre to outsiders.

JimWhatley

Posted at 05:27h, 15 AprilI have a little different take on it. I have always worked in a service industry. The customer is not always right but I try to make the customer happy. Happy customers lead to more. People who are selling their house want it to look good online and be posted everywhere. Zillow does that for me. We just had it where our feed to Zillow was cut off. I was like a junkie with my supply of drug wasn’t there. I did’t like it. The Franchise companies had a back door into Zillow. I didn’t. I contacted Zillow and got results. I have the ability to keep my listing from being syndicate but I chose to syndicate. My job is to list homes for sale, and market them. Ultimately I’m a marketing company. I’m the least expensive what to sell a home in my area. I have found by the end of the transaction the savings are forgotten and the service is what is remembered. I’m always on the mission to make the service better. Happy sellers make happy brokers.

Sam DeBord

Posted at 06:38h, 15 AprilI think you’ve missed the point of the post. It’s about industry-wide brokerage profitability, not individual profits/decisions to syndicate. We syndicate too, but that doesn’t create new buyers for the marketplace as a whole (the zero-sum reference).

Matt Holder

Posted at 07:27h, 15 AprilI feel the two examples given to explain the difference between IDX and Syndication are misleading.

Example 1: IDX

Broker #1 puts his listing on the MLS and therefore all IDX sites of other brokers and their agents. Broker #2 pays $100-$500 per month for his IDX site, which he uses for generating leads he can either provide to his agents or refer to broker #3. To get leads at scale, Broker #2 spends $1k-$10k/month buying Google Adwords and Facebook Ads in order to market his IDX site gets enough traffic to produce enough leads to make money. If Broker #3 is lucky he gets a couple of referrals from Broker #2.

Example #2: Syndication

Broker #1 puts his listing on the MLS and its syndicated to a portal. Broker #2 pays $100-$500 a month to advertise on other agents listings in his market (exactly what IDX allows) and produce leads he can either provide to his agents or refer to Broker #3. The portals spend the money to acquire traffic and operate a best in class site consumers love using, so Broker #2 doesn’t need to spend any further money marketing his website to get leads. Broker #3 is lucky if he gets a couple of referrals a year since this doesn’t happen that often.

You can’t cut out the costs of owning and marketing an IDX site when comparing the costs relative to syndicating. Leads don’t magically pour out of an IDX site without significant marketing effort and spend, which portals offset by marketing at significant economies of scale.

Drew Meyers

Posted at 07:54h, 15 April“You can’t cut out the costs of owning and marketing an IDX site when comparing the costs relative to syndicating. Leads don’t magically pour out of an IDX site without significant marketing effort and spend, which portals offset by marketing at significant economies of scale.”

+1

Sam DeBord

Posted at 09:59h, 15 AprilDifferent argument. Advertising spend is a separate issue. The homes will sell either way. Do industry-wide brokerages make more money in an all-IDX scenario or a syndication scenario?

Matt Holder

Posted at 10:33h, 15 AprilI disagree that it’s a different argument. The ability for Broker #2 or Broker #3 to make any money is to either already have a client (no acquisition costs and no IDX site necessary) or to generate a new client via the IDX site. The home may sell, but if Broker #2 wants a piece he’ll need to find the buyer and you can’t do that by just buying a domain and a subscription to an IDX plugin.

The only way to leverage and IDX site to generate new clients is to develop inbound channels, which are usually done via SEM, Social Media Marketing, and SEO. Developing those channels costs time and money to get dialed in so that you have an IDX site that can actually acquire new users. Those channels are factored into the rates paid for marketing on portal sites, but at a highly reduced rate due to the economies of scale in which they operate. You get a much cheaper CPC for national campaigns than for hyper local ones.

Sam DeBord

Posted at 12:22h, 15 AprilYou’ve focused in on the individual broker again, which isn’t the concept. I could go on for days about how my company generates dozens of IDX leads daily through organic search/SEO but we’re talking about all brokers as a whole.

If everything is IDX, some broker’s going to get the lead, and some broker’s going to get the closing.

In syndication, there’s a portion of the income siphoned to an outside entity. That’s the difference inefficiency for the broker sphere.

To prove the efficiency point, portals are spending tens of millions of dollars building websites that lose money. Brokers are paying a large part of those costs through advertising. Meanwhile, 15 years ago, we had inexpensive IDX websites, consumers used them, and homes sold.

Stephanie Crawford @AgentSteph

Posted at 09:12h, 15 AprilI disagree. Leads do pour out of my IDX website. And I don’t pay a dime to Adwords. I once did, but now Google views my site as authority. I do pay $60 a month for the IDX itself…

Matt Holder

Posted at 10:24h, 15 AprilSure, now that you’ve spent the money on Adwords to get your site to rank well (until their algo changes) and spent your time building whatever content is necessary to get there. That is, assuming you’ve done more than just buy an IDX site. To rank highly in SEO you’ll have needed to develop local content which likely means you’ve spent countless hours blogging – how much is your time worth?

That cost is likely very high, even if you no longer pay for adwords. By comparison, out of the box you can get the same lead flow without paying high lead acquisition costs through the portals. It’s a very powerful marketing channel democratized for all brokers/agents to use.

Christian Sterner

Posted at 10:02h, 15 AprilThis is an interesting post Sam. I guess what is missing for me is the cost of customer acquisition. It is true that brokers could put customers through whatever form of digital hell they want because, well, people need places to live! But, assuming that hell is not the goal, the costs of creating excellent, consumer-centric, digital properties is not being factored into your post. I’m genuinely interested to hear which is more expensive for brokers: being cutting edge or outsourcing that and sticking to transacting?

Sam DeBord

Posted at 12:15h, 15 AprilGood questions, Christian. Yes, customer acquisition costs are relevant to the individual broker. This was more of a broker war room “how do we all cut costs/improve profits” session.

It’s interesting that you frame IDX as the proverbial digital hell. It need not be (ask Redfin). IDX vs syndication isn’t about better consumer interfaces. Those can be built on either platform. It’s about the underlying stakeholders.

Christian Sterner

Posted at 13:21h, 15 AprilA great debate nonetheless, Sam. As a heads up, I was not referring to IDX as a digital hell, but rather pointing to the consumer pain that would be involved if they were forced to navigate only broker sites for relevant info. In my mind, the total revenue of Z/T/R, and therefore agents’ and brokers’ costs, is lower than the collective spend of brokers should they choose to meet consumers where they want to be met. Definitely appreciate the expansion of thought around this topic though. Thanks Sam.

Maine Home Connection

Posted at 17:11h, 22 AprilI don’t really understand the comment that there is consumer pain when forced to navigate only the broker site for relevant info? What does that mean? Broker sites do not feature relevant info? They are hard to use? I would counter argue that portal sites are MORE confusing, full of advertising of all types and include information that is general and not specific and deep when it comes to local information. Providing a good local experience is still something that brokerage sites can provide.

guptapromoters

Posted at 03:45h, 19 AprilNow a days we have seen that brokrage profit is nothing but we have a fear just because we dont have knowledge about property…

Amanda Williams

Posted at 08:52h, 11 FebruaryI have used iHomefinder IDX system and have profited well from it. I customized it to what I wanted and have gotten great leads that have led to sales. I would recommend it to anyone. (http://www.ihomefinder.com/products/omnipress/)