Zillbnb

[Editor’s note: Originally published on Not Boring, a weekly newsletter combining current events, strategy, finance and economics frameworks, and pop culture.]

Ancient Athens With Modern Amenities

Last year, my wife, Puja, and I decided to search for a house in Athens, New York, right across the river from the much trendier Hudson. We were ready to buy our first home, and the thought of spending the amount of money it would take to buy even a shoebox apartment in Brooklyn depressed us. So we decided to buy our second home first while continuing to rent in the city.

We went up for a day, met with our fantastic realtor, and set out to see three houses. It was like the house hunting version of Goldilocks: the first was too small, the second was too dilapidated, the third was justttt right. The house was built in 1885, but the previous owner had recently renovated the place and did a masterful job of updating the kitchens, bathrooms, and appliances, while retaining the wide wood panel floors and other touches that gave the house its charm.

We fell in love; it would make a perfect Airbnb.

We closed on the house last June, and for the past twelve months, we have been one small piece of supply for Airbnb’s aggregation machine. We get to observe a microslice of Airbnb from the inside, and mostly, we experience the things that we expected to:

- People are willing to pay more for the weekend than they are for weekdays.

- In upstate New York, spring, summer, and fall are more popular than winter.

- Lower nightly rates mean more demand.

We also learned some things:

- Older renters are more particular than younger ones.

- Failing to realize that heating oil runs out makes for unhappy guests.

- Adjusting your nightly rate in either direction creates a flurry of demand.

We have a great property manager who takes care of the place as if it’s her own, surprisingly strong demand even in the winter (seriously, if you want to feel the power of an Aggregator firsthand, list a small house in the middle of nowhere on Airbnb), and are able to cover our mortgage payments and taxes with the Airbnb revenue. We thought we were geniuses.

Then in late February, Coronavirus hit, and uncertainty with it. A few guests canceled their weekend bookings and the news confirmed what we were seeing: Airbnb bookings dropped 40-96% in major tourist destinations across the globe. Holed up in our Brooklyn apartment, we worried that our smart investment had become a disaster.

But within days, as the media continued to call Airbnb’s demise, something interesting happened: we started receiving a ton of inquiries.

Every couple of hours, another person or young family from New York City asked if they could rent our home for weeks or months at a time to escape the city and head for the fresh air upstate. Since the beginning of Coronavirus, we have had our best months as Airbnb hosts yet, with average revenue about 25% higher than in the first year.

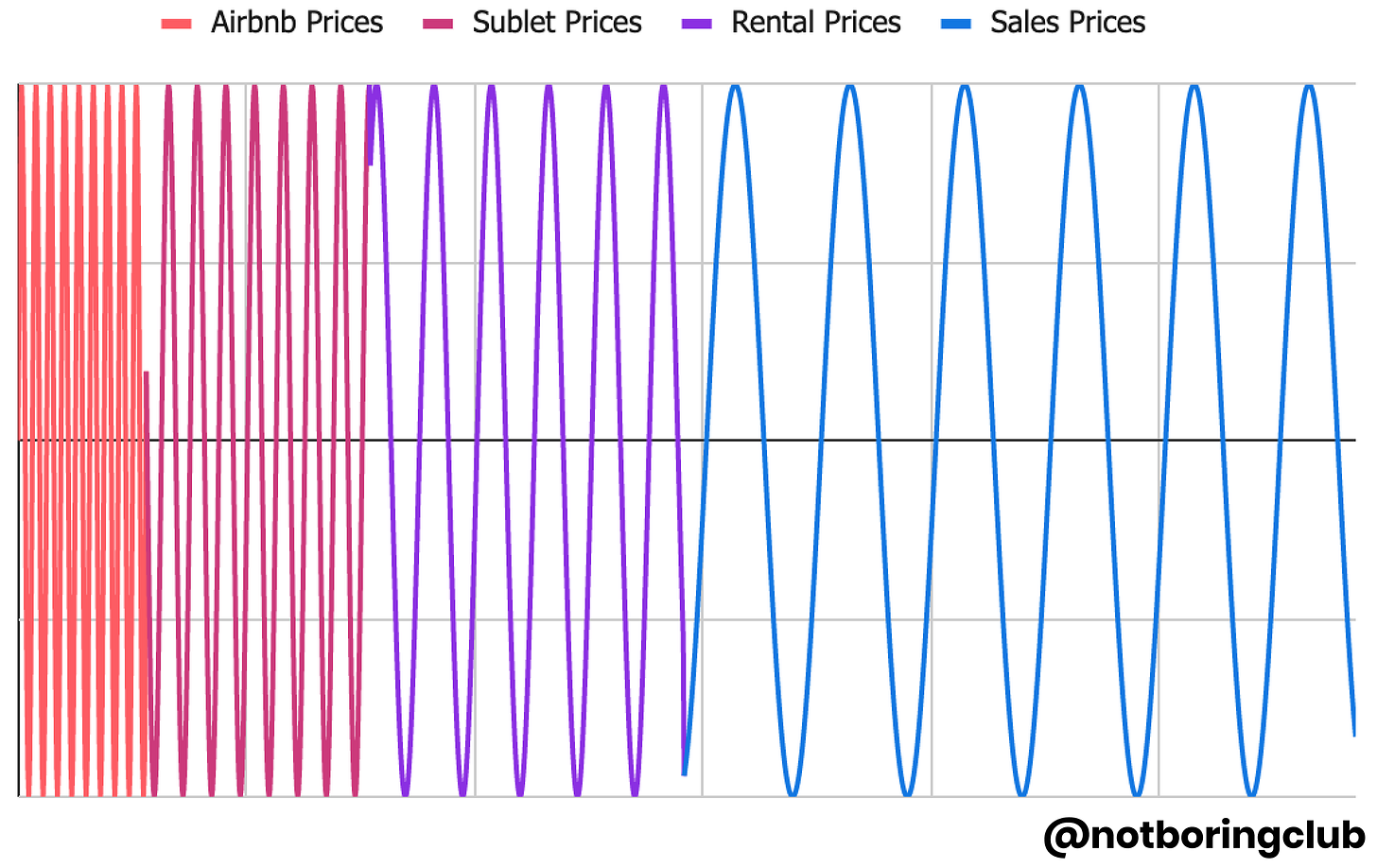

I recognized something from my time at Breather: the easiest-to-book, shortest duration reservations respond more quickly to changes than heavier, longer duration reservations. At Breather, prices for our hourly reservations moved much more quickly than prices for the 5-year leases we signed. We could tell when a neighborhood’s office real estate was going to become more expensive before landlords could.

Similarly, Airbnb demand should be predictive of sublet demand, which should predict leasing demand, which, in turn, should predict home sale demand. Following that logic, I guessed that since more people were booking Airbnbs upstate, and fewer were booking in the city, home prices would soon rise upstate and fall in the city.

This week, I got a text from a friend who was looking to buy a house upstate. Turns out he wasn’t the only one. His realtor told him that homes in the area were trading at 20-30% above where they were just a few months ago. Bad news for him, but great news for us. We called our realtor and asked what we might be able to get for our house. He told us he’d do some research and call us back.

“Guys, I’ve done some digging, and I think we should try to list your place for 30% above where you bought it last year.”

Airbnb and Zillow Should Merge

On the micro level, Airbnb’s predictive power is great news for us. We were able to see that demand was increasing in the region before most other people, and are going to get our house on the market before others do.

On the macro level, this phenomenon points to an opportunity for a merger between two of residential real estate’s largest tech companies: Airbnb and Zillow.

Over the past year as home buyers, Airbnb hosts, Airbnb guests, and now sellers, Puja and I have noticed places where a combined Airbnb and Zillow would complement each other perfectly. Try before you buy, access to lending based on Airbnb cash flows, rent to own, more accurate Zestimates, and click to buy are just a few of the things on our wishlist that could be solved in an Airbnb / Zillow merger.

If you’re thinking, “This guy’s an idiot. The only thing worse than one unprofitable real estate company during a global pandemic is two,” I would say: Ouch, I might be, but this is Fantasy M&A and the merger is intriguing for a few main reasons.

- Airbnb and Zillow are Yin and Yang: Airbnb is short-term, Zillow is long-term. Zillow is a scientist, Airbnb is a designer. Airbnb gives Zillow unmatched iBuying capabilities, and Zillow gives Airbnb SEO firepower.

- Zippier Zestimates: Airbnb’s data would improve the accuracy of the Zestimate and make it more responsive and predictive.

- Belong Anywhere, for Any Amount of Time: Instead of vertical or horizontal integration, this merger would represent Duration Integration. One place for consumers to book homes at every time interval – from one night to forever.

- Liquid Real Estate: Together, Airbnb and Zillow can make real estate more tradable, like stocks.

- Product Moonshots: The combined companies would be able to create more innovative products and experiences than either could alone.

The stakes are high. The total value of homes in the United States alone is $33.6 trillion, US hospitality is a $200+ billion industry, and the global hotel industry is a $525 billion market. Real estate and hospitality continue to blend, and Coronavirus changed the way that we think about where to live: our residence may no longer be one address in one city, but rather a series of cities and addresses that we sample or rotate through over our lives. Together, Airbnb and Zillow would be the leader in this new housing world.

Opposites Attract

For better or worse, Airbnb and Zillow are yin and yang.

Airbnb, led by RISD graduate Brian Chesky, has the soul of a designer. When Airbnb wanted to improve its customer experience, for example, it hired a Pixar illustrator to storyboard the customer journey.

Zillow, led by founder Rich Barton, who also founded Expedia and Glassdoor, has the soul of an engineer. In each of Barton’s companies, he uses data to grow scientifically. His companies follow the same playbook – expose previously hidden data (flight/hotel prices, home prices, employee reviews), attract users, create a unique page for each entity (homes, companies), and rank high in search results.

Airbnb’s brand color is pinkish, Zillow’s is blue. Airbnb is headquartered in San Francisco, Zillow calls Seattle home. Airbnb is an experience company, Zillow is a product company. Airbnb facilitates short-term rentals and calls anything over 30 days “long-term.” Zillow facilitates home sales and leases, and calls anything under 1-year “short-term.”

The merger has the potential to create one company that blends art and science, short-term and long-term, customer obsession and powerful data, the sharing economy and the economy economy. Read Barton’s interview with Ben Thompson; it’s one of the most insightful CEO interviews I’ve read, and I think he has what it takes to pull this off.

Airbnb and Zillow have taken nearly opposite paths to becoming two of the largest and most well-known real estate tech companies, and their merger would enable each to help solve the other’s challenges.

Airbnb Can Lower Zillow Offers’ Risk, Expand the Buyer Pool, and Boost Yields

Zillow, which began its life as a home listing platform, has expanded into iBuying through its Zillow Offers product – in which it takes principal risk by buying and selling homes – and mortgage lending. Zillow’s current market cap is $13.7 billion, and it’s trading just 5% off of its all-time highs after reporting stellar Q1 earnings, in which the company reported revenue more than twice as high as Q1 2019, buoyed by an increase in revenue from Zillow Offers from $128 million to $769 million.

But investors are still worried about Zillow’s ability to generate profit from Offers; the company itself estimates that it can generate returns of 4-5% from the product, much lower than the software margins investors originally bought into. The market is so uncertain about Offers that Zillow’s stock price rose 14% on March 23rd, the day that Zillow said it would temporarily suspend the program due to Coronavirus.

Zillow will be back in the market, though. It’s betting that 4-5% gross margins in a massive market – home buying – will ultimately prove more profitable than its historical 90% gross margins in a much smaller market – home listings. It’s a risky bet! Zillow now carries homes on its balance sheet until it’s able to flip them.

Plugging in Airbnb would lower Zillow’s risk and improve its yields. Instead of a binary outcome – buy the house for $x and only profit if Zillow can sell the house for $x+y – Zillow could turn on short-term rentals to generate income while looking for a buyer at the right price.

Zillow may even choose to continue to operate the homes it buys as short-term rentals on Airbnb instead of selling, based on predictive calculations of which offering will produce higher yields. Short-term rentals can generate 30% higher rates than long-term rentals. Airbnb has even shown a desire to own and manage its own supply with Backyard.

Zillbnb has the opportunity to build something more potent than Blackstone’s Invitation Homes, on which the private equity firm netted about $7 billion by buying up a portfolio of single-family homes in the US and managing them as rental properties. By using Zillbnb’s combined data, the company can make sharper offers based on both short-term and rental cashflow predictions. By offering Zillow Offers homes for one night, one month, one year, or forever, Zillbnb would be able to optimize yields based on where each duration prices in each market.

Joining forces with Airbnb might even increase the buyer pool for Zillow’s homes. Selling homes with Airbnb up and running turns a home into a turnkey small business, making it attractive to financial buyers looking for yield in a low interest rate environment.

Zillow Can Help Airbnb Lower Marketing Costs and Regain Profitability

Airbnb has some challenges of its own that Zillow would help solve.

Since its founding in 2008, Airbnb has been a darling of the tech industry – an early Y Combinator success story, trailblazer in the sharing economy, and one of the most anticipated IPOs of 2020. Due to Coronavirus, however, Airbnb has put its IPO on hold and laid off 25% of its employees. It raised $1 billion in debt from Silver Lake Partners at 10%, and warrants attached to the debt – which gives Silver Lake the option to convert its loan to shares in the company – valued Airbnb at $18 billion, down from $31 billion in its last round.

Even before Coronavirus hit, Airbnb faced some serious existential threats. In Long WeWork, Short Airbnb, my friend Dror Poleg pointed out that Airbnb faces serious competition from well-capitalized, profitable giants, namely Marriott, Expedia Group, and Booking Holdings. Those companies combined to generate about $10 billion in annual profits in 2018, while Airbnb lost $322 million in the first nine months of 2019. A big reason for the losses is that the whole travel industry – including Expedia and Booking – is paying more to acquire customers as Google has squeezed them out of search results with its own travel modules.

Spending to compete in that space is destructive, as Airbnb has discovered. Zillow, on the other hand, plays in a space that doesn’t face the same headwinds as the OTAs. For now, Google doesn’t have a home buying module, and Zillow is taking full advantage.

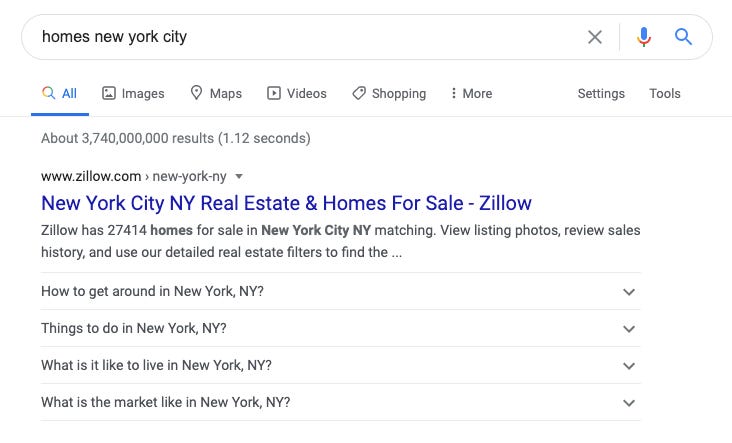

Barton built Zillow to be an SEO machine, and it works. Look what comes up when you search for “homes New York City.”

In Making Uncommon Knowledge Common, Kevin Kwok explains how Zillow takes advantage of data content loops to own the demand side of real estate. It pulled together disparate data to create the Zestimate, and exposed that data to the public, which drove people to Zillow. It also used the Zestimate to create a listing for every home, which drove more people to Zillow, which improved its SEO, which means even more people come to Zillow, and so on. Now, when you search for homes in nearly every city, Zillow is the top result. Zillow is the Aggregator for home sales and rentals.

Short-term, Zillbnb will need to take advantage of Zillow’s current SEO advantage before Google does the same thing to homes that it has done to hotels. One could imagine adding a “Book on Airbnb” to the millions of home listings pages that Zillow owns, giving Airbnb an instant leg up over its competitors, and backlinks from Airbnb to Zillow to learn more about the home and maybe even to see if it’s for sale.

Medium-term, Zillbnb’s goal will be to become the starting point for any home search, from an overnight stay to a purchase. If people go to Zillbnb.com before Google when they’re searching for a place to stay for any duration, the company becomes much less sensitive to Google pushing organic home search results further down the page.

There is precedent here – Amazon has become so synonymous with ecommerce that more shoppers start their search on Amazon (46.7%) than Google (34.6%), according to emarketer. Shoppers start on Amazon because they know they can find everything they’re looking for in one place. Zillbnb would offer the same thing in housing.

As our concepts of travel and living, of hospitality and home sales continue to blend, giving consumers one destination for all of the above provides an advantage – “a service so wonderful that people just come back to them directly.” In other words, Zillbnb would be the ultimate home Aggregator.

Zippier Zestimate

The Zestimate is the core of Zillow’s business. The ability to see the estimated price of any home by typing in an address is a customer magnet, and the company’s ability to algorithmically price a home is the engine that drives the Zillow Offers business. If Zillow believes that it can price a home better than anyone else, it should be the most sophisticated house flipper in the game, beating out competitors like Opendoor by leveraging its data advantage.

The company has poured its own engineering resources into making the Zestimate accurate, and even hosted a data science competition on Kaggle, awarding a $1 million prize to a team that made the Zestimate about $1,300 more accurate.

In stable markets, the Zestimate is a useful tool, accurate to within about 5%. But the Zestimate is slow to respond to change.

Before we called our realtor, I pulled up the Zestimate for our house. It was a modest 4% higher than our purchase price, and 20% lower than our realtor’s ultimate recommendation. If we had just looked at the Zestimate, we wouldn’t have given selling our house a second thought.

The challenge that the Zestimate faces is that home sales prices are the last to respond to changes in real estate demand.

Airbnb can fix that.

The graph above a) took me way too much time to create, and b) shows that prices are slower to respond the longer time commitment involved.

Sale prices are last to respond because they are irreversible and they happen once. Right now, across the country, many homeowners in cities most impacted by COVID are holding out for as long as they can to avoid selling into a down market. If they can make ends meet, they reason, they’ll be able to wait to sell their home when things recover and avoid losing money on what is likely their biggest investment to date.

Airbnb hosts, on the other hand, are willing to take what they can get for each booking (assuming the guest pays cleaning charges) because bookings happen every night, prices can adjust daily, and inventory expires. Tonight only happens once, and by tomorrow, it’s gone. If Airbnb hosts have to choose between renting their place for $50 or $0 tonight, they’ll take the $50. Hopefully, tomorrow is a little better and they can charge $60, maybe in a month or two, they’ll be back to their normal $200 per night. They’ll have been making money all along.

Because of that dynamic, Airbnb knows about the demand in a particular area, and for a particular home, before anyone else, including Zillow, does. Its pricing recommendations for hosts, while probably set too low in order to stimulate demand, are much more responsive and nuanced than the Zestimate.

By feeding Airbnb’s data into Zillow’s algorithm, the combined companies could create a zippier Zestimate, one that responds in real-time to changes in demand. There’s a chance that each company already incorporates the other’s data in a rough way, but they would benefit from a tighter integration and knowledge sharing.

Generally, “data moats” are bullshit, but in this case, improved data helps value homes better, which allows Zillow to front-run markets with its Zillow Offers product. Airbnb yields are already becoming a useful valuation metric, allowing investors to value a home based on its cashflows. When we asked to list our house, for example, our realtor asked us to send him our monthly Airbnb revenue, because potential buyers are now using that information to decide how much they can afford to pay.

An improved, real-time Zestimate also makes Zillbnb a more attractive destination for consumers. Zillow has built an unrivaled real estate demand engine by creating a pricing estimate tool that people check occasionally. Imagine if the estimated price of peoples’ largest investment changed every day in response to changing market conditions – people would check Zillbnb as much as they check Robinhood. Zillbnb would be the ultimate real estate destination site, giving the combined companies the ability to cross-sell homes for any amount of time (and, of course, Experiences) to the millions of people checking the site daily.

Accurate, real-time home prices would be a moat that would be nearly impossible for any competitors to overcome, just as the ability to find a home for any length of time would create a value proposition that customers would love.

Belong Anywhere, for Any Amount of Time

Together, Airbnb and Zillow would allow consumers to book any length of stay in one place, from one night to forever. They’re already bleeding into each others’ territory.

Launched to help people turn extra couch space into a little extra income, Airbnb has turned much of its attention to longer-term stays, bookings over one month long. One out of every seven nights booked on the platform is part of a longer-term stay, and Chesky has said that long-term stays are one of the company’s top three priorities.

We’ve seen that first-hand in Athens – our average booking increased from three nights to over two weeks, and one guest just booked all of September and October.

The natural next step is even longer stays, and that’s where Zillow comes in. In fact, looking for longer-term rentals to carry them through COVID, many Airbnb hosts are already turning to Zillow. Zillow is seeing increased demand for short-term (6 months or less) and furnished rentals. Furnished rental listings increased 42.8% between March 1 and May 21, and short-term rental listings rose 23% in the same period.

Hosts are increasingly listing their homes on both platforms, and guests are looking at both to find a place to stay. By combining forces, Zillow and Airbnb would give both sides of the marketplace – guests/buyers and hosts/sellers – one place to go for any duration. That might mean one night or one month. It might also mean forever.

This is a win from the consumer perspective, and a win for the company. Offering products at more durations allows the combined company to smooth out cashflows. For example, Airbnb generates the most revenue in the summer, when more people travel in the US and Europe. Since home sale timing has a low correlation with travel timing, combining the two would create overall more stable cash flows.

Beyond just smoothing out cash flows, allowing consumers to transact real estate at any time scale can expand the whole market by liquefying real estate.

Liquefying Real Estate

Public company ownership is liquid. People (and machines) trade ownership in companies every millisecond, facilitated by fractional ownership (a share in a public company is a tiny fraction of the overall company), real-time data, and a global market of financial buyers and sellers who don’t need to actually operate the companies whose shares they purchase. Markets allow people to diversify, to create a loosely correlated set of baskets in which to put their eggs.

Real estate, on the other hand, is relatively illiquid. The median duration of home ownership in the US is thirteen years, and for the vast majority of homeowners, the house represents the largest investment they will ever make. Home ownership is as “all your eggs in one basket” as it gets. Not only is your home where your money lives – home values represent about 20-30% of a person’s net worth – it’s where you live. People have insurance to protect against disasters that destroy the physical parts of their home, but nothing to protect them against declining home values in the city or neighborhood in which they’ve chosen to live. Plus, most homeowners go deeply in debt in order to afford the place.

The way we own and transact real estate is crazy, but historically, it’s been the only option.

Today, a host of new startups are working to provide alternatives. Point enables homeowners to sell equity in their homes instead of having to raise debt via a mortgage. Divvy operates a rent-to-own model, in which monthly rent payments accumulate and become your down payment when you’re ready to buy. Point and Divvy are good starts.

Zillbnb would bring real liquidity to the market, though. A more accurate, zippier Zestimate would provide the price transparency required to make shares in homes more tradable at scale. The short- or long-term stays that people are doing anyway could open up rent-to-own options to millions. One level above a 5-star review, the combined company might ask, “Love your stay? Click here to invest in the property.”

Instead of owning just one home, Zillbnb customers might be able to buy a portfolio of homes in different locations, representing a financial tie to the places they’ve traveled and the experiences they’ve loved, and diversifying their risk. It sounds like a crazy idea, but I think that in twenty-five years, we will look back and think that the way we do it today was insane.

Plus, I’ve got even crazier ones…

Product Moonshots

What’s the fun in doing fantasy M&A if you don’t let your imagination run a little wild? I’ve thought of a few product moonshots that only Zillbnb could create.

Zillbnb Offers. Currently, Zillow invests in the homes that it purchases for its Offers product via its balance sheet. What if, because of real-time price transparency, consumers were able to fund Offers by buying and selling shares in particular homes or baskets of homes. Roofstock does something similar today, without the benefit of Zillbnb’s reach, scale, and demand.

Experience Before You Buy. Imagine being able to live in a house for a month before you decide to buy it. You could get to know its quirks and its charms before committing. You might even be able to book Experiences in the neighborhood, like going to dinner with some of your future neighbors, taking in a play with locals, or taking your kids to a Little League game with team parents. That experience would enable you to determine whether you “Belong” before making the biggest financial decision of your life.

Click to Buy. Zillow already has price estimates and a mortgage lender. Airbnb already has people staying in someone else’s home millions of times per day. Why couldn’t Zillbnb offer a “Click to Buy” option after guests complete their stays? Now that we’re thinking about selling our house in Athens at the same time that more guests are staying there longer, I would love to be able to let them know that it’s for sale, increasing the demand for the property and potentially fetching us a higher price.

Zillbnb Subscription. With more people allowed to work remotely from anywhere, Zillbnb could offer a subscription product, a modern-day timeshare on steroids. For one price, I could live in the mountains during the winter, by the beach during the summer, in the city during the spring, and in the country during the fall. I would also be able to offer my home to others, making the whole thing cost neutral while increasing my flexibility. Because these stays would be longer than 30 days, they would get around many of the regulations blocking short-term stays in cities like New York.

Just thinking about these possibilities gets me excited. On a long enough time scale, they’re inevitable – the market adapts to what consumers want – but a Zillow/Airbnb merger would make them possible much sooner than any other entity could.

Make it Happen, Rich and Brian!

Any potential merger is fraught with complications, and this one is no different. Blending art and science might not take – what if the two companies’ cultures just don’t fit? What if Airbnb data isn’t actually a great predictor of home values? How to deal with Airbnb’s international presence and Zillow’s US focus? What will the regulators say? Isn’t packaging and selling slices of homes what led to the 2008 financial crisis?

Sure, but this is fantasy M&A, meant to make us think about the possibilities, of the upside potential if the companies are able to figure out all of the financial, operational, and regulatory complexity.

And the fantasy is compelling. A merger between Airbnb and Zillow would create an unmatched residential real estate aggregator, and build moats around two businesses that, while big by startup standards, are still actually pretty tiny compared to the markets in which they operate – housing and hospitality.

Most importantly, a combined Zillbnb has the potential to speed up the transition to the future in which we interact with and transact real estate in a much more fluid way. It would allow real estate to evolve in line with the shift to more flexible and remote work, and it could smooth the dichotomy between home ownership and diversification.

If you know Rich Barton or Brian Chesky, please forward this email to them. The Zillbnb future is the one I want to live in.

Sorry, the comment form is closed at this time.