A Look Forward to 2020: Bundling Shows Life

[Note from the editor: We publish a Weekly Transmission for Geek Estate Mastermind members that consists of long-form articles covering the spectrum from shipping container co-living spaces to the battle for listing acquisition in the first iBuyer world war.

Below is a sample Transmission, a collection of 2020 predictions and trends sourced from members. —Drew Meyers]

A Look Forward to 2020: Bundling Shows Life

BY DREW MEYERS

Originally Published: January 14th, 2020

We’ve spent the last decade unbundling. I see kernels in the reverse unfolding this year, leading to a massive re-bundling decade ahead.

Brokerages should continue iterating on delivering bite-sized segments of certainty wherever possible, but buyers and sellers ditching their existing relationships is a giant mountain to climb. It’s inevitable that iBuyers will begin to offer trade-up/in services and that brokerages will have to continually increase the breadth of services to win home buyer/seller favor. Nowhere will this bundling play out more than in the property management sector, as distribution reigns king for a wide range of home maintenance and personal finance offerings.

While certainty as a service will continue running rampant across both residential and commercial, those providing services–or at least curating/aggregating them–across the entire spectrum will win the day. And the decade.

Below is a range of trends of interest and predictions for 2020, sourced from the Geek Estate community…

TRENDS

CONTINUED CONVERGENCE OF REAL ESTATE AND PERSONAL FINANCE

Ryan Coon // Co-founder & CEO, Avail

Real estate has always been intertwined with personal finance, but we’ll see the linkage between the two become even stronger in 2020.

Although most rent payments are still made offline, renters will increasingly expect faster and cheaper rent payments–and credit-boosting rent payments will become the norm. We’ll also see more adoption of innovative solutions that help renters along the path to homeownership, such as Rhove and Digs. As renters pay on-time, their credit scores will improve and they’ll also be rewarded with savings toward an eventual down payment. Innovative rent-to-own models such as Divvy Homes and Arrived will pick up steam, helping make homeownership a real possibility for those who don’t yet have their personal finances in a place to buy a home.

In the past, real estate was an investment available only for the wealthy. New models are changing this–and will lead to the adoption of real estate as a personal finance asset class for Main Street. While crowdfunding platforms, like Fundrise and Small Change, haven’t gotten as much attention as when they first launched, they continue to allow people to diversify their personal investments into real estate. Innovative real estate investment platforms like Roofstock/Roofstock One, DiversyFund, Compound, Landa, and Concreit are also making real estate wealth building more accessible.

BROKERAGE TIMES ARE A CHANGIN’

Pierre Calzadilla // VP Growth, Local Logic

Compass: A major chink in Compass’ “armor” will be exposed: Agents don’t stay. Expect exodus from top performers as all the acquisitions hit their one-year mark and people take their money and run. Compass will buy at least three more independent firms.

Side: With fresh cash, a hungry team, a strong value prop, and on track for $8 billion in annual sales in 2020, Side will go big in 2020 and make a name in the business as consumers aren’t even aware–because they don’t care. They just love that it all works and the agents are great. Industry will finally take notice and we’ll see Side everywhere by the end of 2020.

eXp/KW: Alongside another lawsuit and more vitriol, eXp will do something to breakout this year. Keller won’t expect it and Gary’s gonna be pissed he missed it.

Realogy: Realogy will spin off brands, like Corcoran and maybe even all of NRT, for a huge windfall. Imagine if the Louis Vuitton group bought Corcoran? Then Realogy will take its tech stack and spin that off as a new company, making its tech available to the entire industry. Realogy will hold on to the franchise business, simplify its revenue model, and assign losses to the right balance sheets.

THE CONSTRUCTION INDUSTRY CONTINUES TO CRACK UP

Stephen Del Percio // VP & Assistant General Counsel, AECOM

In the aftermath of the 2016 election, construction industry firms were anxious to consolidate. The federal government was on the verge of passing generational infrastructure investment legislation, and firms perceived an opportunity to capture increased market share by collapsing design, construction, and operations and maintenance expertise under one roof.

But a funny thing happened on the way to the drafting room. An infrastructure bill never passed Go. Firms continued to bid large fixed-price contracts and risky public-private partnerships. In 2019, public companies like Fluor, Granite, and Tutor-Perini saw billions in market capitalization wiped away thanks to problem projects and larger quarterly losses. And investors pushed back on visions for fully integrated infrastructure firms that could design, build, finance, and operate major projects on their own.

In 2020, the construction industry will continue to segment, which I think will reverberate across the construction tech scene. Firms will get back to basics, whether it’s performing only professional design services, construction management, or whatever their core competency might be. This focus will, in turn, lead to increased scrutiny of overhead costs and process and workflow management–both critical areas where tech solutions can play pivotal roles for firms’ bottom lines.

Already, industry observers are suggesting that contech can be part of a solution for rising construction costs, labor shortages, and other inefficiencies that have always plagued the industry–2020 could be the year that it takes a permanent seat at the table.

THE ROLE OF THE AGENT WILL CHANGE DRASTICALLY

Jon Boller // co-founder & CEO, BizFin

There’s a lot of talk from executives surrounding the antiquated nature of the real estate transaction and “how awful the experience of buying and selling homes is.” As a result, alternative, nontraditional real estate business models are emerging: iBuying, alternative financing companies, and discount brokerages are creating a unique marketplace where consumers are provided optionality. Gone are the days where consumers accept paying a set fee without exploring their options.

The modern day real estate agent will be an expert at walking consumers through the financial and long-term impact of going with an iBuyer and how to create wealth through homeownership. Consumers also may explore purchasing a home slightly outside of their budget via non-traditional financing options. The most consumer-centric agents are going to win and those willing to make data, analytics, and insights as the core of their businesses will increase their market share over the next 12-24 months. Agents will embrace technology to make their businesses more efficient and increase their revenues, leading to profit margin expansion.

FRAUD REARS ITS UGLY HEAD

Nate Smoyer // Director of Marketing, Avail

The amount of money moving around and consumers’ unfamiliarity with real estate processes makes our industry a magnet for fraudsters.

This starts with the continued rise of wire fraud on purchase and sale transactions: One of the major challenges is that there are many gaps in the transaction that allow someone to influence or hack their way in to redirect down payments or entire purchase amounts to fraudsters’ accounts. This can be done with simple phishing emails or more sophisticated attacks leveraging malware. The President of Sun Title estimates, in total, that this is a $10 billion problem. Transactional management platforms, like Propy, stand a strong chance to shine by securing transactions using blockchain technology.

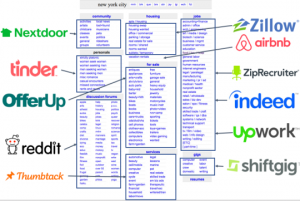

The second way consumers fall victim to wire fraud is through fake listings. Fraudsters convince prospective tenants to wire their rental deposit in order to get keys and then vanish. Methods deployed to combat fraudulent listings include advanced algorithms and SMS text confirmation. Unfortunately, fake listings still squeak through, victimizing tens of thousands annually. Companies like Zillow and Craigslist are taking the approach of charging for listings to thwart spam and fraud. I don’t think charging for listings is the best approach. There’s a lot to win here for whoever can best reduce listings fraud and establish trust with consumers.

PROPTECH VC GOES GLOBAL

Ashkan Zandieh // Chief Intelligence Officer, CREtech

Mega rounds will be in vogue in 2020, as investors begin placing larger amounts of capital to work in established companies. In Latin America, Loft’s $175 M round to scale iBuying in Brazil was the first mega round of the year and also catapulted the young company to unicorn status.

In terms of geography, it’s no secret North America, especially the US, is the leader in proptech both in deal and investment volume. Overall, the industry closed out 2019 with eight consecutive billion-dollar funding months. However, the global landscape of proptech is changing, and the dominance the US once had will start to be challenged. Investment activity has begun to pick up in Asia over the past year. The positive venture capital market and appetite for mega rounds will begin to rival that of the US as China’s proptech ecosystem continues to grow. The European market has positioned itself to make up ground in 2020 in terms of deal volume. Markets like London, which has long been a fintech power, will look to back some of its homegrown companies in 2020.

FUNDAMENTALS PREVAIL & MARKETING TAKES CENTER STAGE

Christian Sterner // Co-founder & CEO, WellcomeMat

Even with the global trend of historically low and negative interest rates, broken models and insolvent businesses (able to hide behind cheap capital for too long) will begin defaulting on debt and disappointing investors with increasing vigor. As such, we will see an increased focus on gross profit for technology companies and decreased investment, which will shine a light on and benefit companies and management teams running companies with a long-term outlook. We will watch fundamentals prevail again in 2020.

The hottest markets are turning sour in the US. As that happens, agents, teams, and brokerages will spend what it takes to stand out amongst growing inventory. Companies focused on providing superior marketing will see a very strong growth period going forward.

PREDICTIONS

ZILLOW GROUP STOCK UP AT LEAST 50%

Terry Dwyer

Zillow’s Q1 and Q2 2020 financial numbers are going to surprise a lot of people. Based on its recent stock price recovery almost to its pre-iBuyer price, a lot of people have already determined that Zillow’s pivot to the iBuyer business was the right thing to do.

Two sets of numbers do not necessarily make a trend, but it’s hard to ignore Zillow’s Q2 and Q3 2019 numbers for both its overall business and its Homes (i.e., iBuyer) segment. Its iBuyer costs in those two quarters covering sales & marketing, technology & development, and G&A all indicate that they should continue to trend down on a percentage basis relative to the overall Homes revenue for the next two or three quarters.

The big number in question, of course, is the “cost of revenue” line item or the actual costs directly related to the acquisition, maintenance, and sale of homes for a given quarter. If past performance in other areas of its business is any indication, executives are quick studies and have no problem applying lessons learned from past mistakes. The iBuying business itself is not a high margin business, but then again, neither is the traditional real estate business regardless of how much technology one throws at it. It’s the cross-selling opportunities that will make bigger profits for this initiative down the road. Couple that with Zillow’s long-expected shift from upfront lead-gen fees to more profitable back-end referral fees and the future looks bright for the team in Seattle.

ZILLOW ACQUIRES OFFERPAD

Drew Meyers // founder, Geek Estate

I predicted an Opendoor and Offerpad merger last year, but it wasn’t to be. With both a history of very large and bold acquisitions (ie. Trulia and Dotloop) and needing to fend off Opendoor from cementing itself as the category leader, Zillow Group will acquire the next best thing to sweeping Opendoor under its umbrella: Offerpad. Bringing the #3 player in-house would add obvious scale to its Homes business as well as a partnership with Keller Williams’ 100k+ agents.

IBUYER FAILURE

Jon Boller // co-founder & CEO, BizFin

A handful of iBuyers will go out of business due to operational inefficiencies and challenges with margins and execution. People are willing to pay for convenience on tasks like cab rides, food delivery, etc. However, they are less likely to give up thousands of dollars in home equity as this often serves as their retirement savings accounts. iBuyers have slim margins to run on, have to be perfect at pricing homes, and then have to be able to turn around the selling of the homes quickly to avoid carrying costs at scale. The operational challenges of a high touchpoint, people-intensive, and low margin initiative will force investors to challenge and question investing in these companies by the end of the year.

PROPERTY MANAGEMENT SOFTWARE TESTS DIRECT SALES INTEGRATION

Drew Meyers // founder, Geek Estate

Why can’t a tenant easily buy a property from their landlord, without an agent? 2020 will mark the year property management software pilots facilitating the paperwork and legal work for tenants to make the jump from renter to owner.

Closing

That’s a wrap! Agree or disagree? Are there trends missing that you’re bullish on? What do you see coming down the pipe in the next decade that will have its seeds planted this year?

GEEK ESTATE MASTERMIND BRIEFING

A PRIVATE GROUP OF INDEPENDENT THINKERS, FREE FROM SPONSORED MESSAGES, SALES PITCHES AND NOISE

There are four parts to membership:

- Long form articles covering the spectrum from shipping container co-living spaces to the battle for listing acquisition in the first iBuyer world war (Weekly Transmission).

- Curated real estate, startups, & built world links & analysis blended with out of the box ideas (Weekly Radar).

- Special reports (our first is a category review of Small Landlord Prop Mgmt Software).

- Networking opportunities with 225+ innovators from across the globe through the private forum & in-person gatherings.

Membership is $109 / quarter

OUR MEMBER PROMISE

- We deliver an exclusive, objective lens into the trends, companies, people, and ideas shaping real estate technology with thought-provoking analysis and conversations that keep you inspired every week.

- We help you make better, more well-informed decisions to help grow and support people and companies making a difference in real estate.

- We enable discovery and meeting others with shared interests online and in-person (whether they live near you or are traveling to the same conference).

With a mission to attract the 1,500 most forward-thinking, and diverse, innovators, we’re looking for the best and brightest in all the land...

READY TO JOIN RIGHT NOW?

NOT QUITE READY?

Sorry, the comment form is closed at this time.