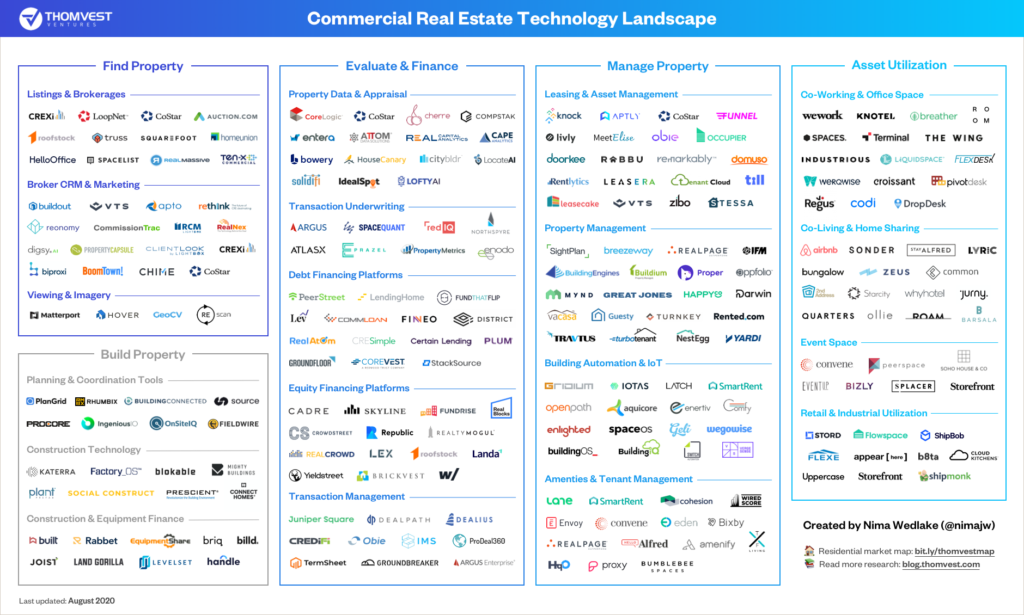

Market Map: 220+ Technology Companies Reshaping Commercial Real Estate

[Note from the editor: Originally published on Thomvest’s Blog]

Today we’re releasing an updated version of our commercial real estate technology market map. The full list of companies is available here, and a high-resolution version of the map can be accessed here. This market map includes more than 220 technology companies operating across every aspect of commercial real estate, and range from seed stage businesses to public companies. If you’d like to suggest a company to be added to this market map, please submit them using this form.

Broadly defined, commercial real estate (CRE) includes any property owned to produce income. In total, more than 100 billion square feet of space in the United States is devoted to commercial use. Because commercial property is acquired for investment purposes, it differs from its residential counterpart in several important ways:

- Commercial real estate is a diverse asset class that can take on many forms: office buildings, retail stores, malls, apartment complexes, homes, hotels and more.

- Every property is analyzed for its ability to generate income. In most cases, there is a leasing component to commercial property ownership (which is the main revenue-generating activity), whereas in residential real estate properties are often owner-occupied.

- Commercial properties are actively managed by teams responsible for leasing, routine maintenance, improvements and amenities to ensure that the building is suitable for occupants.

As the map above indicates, there are hundreds of technology companies across every aspect of the commercial real estate lifecycle, from property search and financing, to leasing and ongoing management. You’ll notice that several companies are included in more than one section — this is due to the fact that many of these businesses have expanded their product areas to capture multiple phases of the CRE lifecycle. For example, VTS recently launched a listings marketplace offering to compliment its suite of leasing and asset management tools. As such, we’ve included VTS in both the “Find Property” and “Manage Property” sections.

Assessing the Impact of COVID-19 on Commercial Real Estate

It’s no secret that the pandemic has dramatically altered our ability to utilize commercial real estate. The pandemic has impacted every CRE segment (office, hospitality, retail, etc.) and every phase of the asset ownership lifecycle (leasing, financing, utilization, etc.). The pandemic will likely continue to influence occupiers and end users of real estate in unprecedented and unique ways, which will have implications for the entire CRE industry.

This is particularly true in the office segment, as the abrupt change in the way we work has required mass remote working. Interestingly, as companies have transitioned from office work to remote work, many employees are reporting no meaningful impact on productivity. Even as lockdowns are slowly eased, as many as 75% of employees prefer to work from home out of caution or convenience. This has caused many in the industry to ask: Is the office as we know it dead?

Given these lingering existential questions, we’re witnessing the reimagining of office environments designed to anticipate what the “next normal” will look like. Tenants and landlords are working hard to determine an approach for re-entering the office, and the impact of remote work on future space needs. While there are many questions we’ve yet to answer, we anticipate the office category evolving in several important ways, and expect technology companies to play a central role in that evolution:

- Emphasis on Safety: As new case volume persists, businesses have been cautious to re-open offices. In an August survey of 15 employers that collectively employ about 2.6 million people, 57% said they had decided to postpone their back-to-work plans because of recent increases case volume, according to the Wall Street Journal. Employers are also developing safety measures to facilitate a smooth re-opening, including redesigned workspaces and temperature checks. We expect additional safety standards to be developed, including staggered employee schedules, space plans to promote social distancing, safe hygiene practices, cleaning protocols, and guidance on using elevators. Technology is a key component of ensuring that both tenants and landlords abide by these emerging safety protocols.

- Flexible Work Arrangements: The pandemic catalyzed a massive work-from-home experiment. In many cases, employees actually prefer remote work as it provides flexibility, reduces (or eliminates) commute times and enhances productivity. More than 75 percent indicate they would like to continue to work remotely at least occasionally, while more than half — 54 percent — would like this to be their primary way of working, according to IBM. The forced shift to operating remotely has led to nearly 40 percent of employees indicating they feel strongly that their employer should provide opt-in remote work options when returning to normal operations.

- Flexible Space Needs: As offices reopen after COVID-19 shutdowns, we will likely see a mix of new use cases. Some companies will require more office space to further space out employees and reduce potential transmission, while others will move to permanent work-from-home arrangements or a hybrid of home, co-working, and office spaces to minimize commutes and maximize social distance. This will create more demand for flexible office space, including co-working space offered by companies like WeWork and Industrious. According to JLL, 67 percent of corporate real estate decision-makers are increasing workplace mobility programs and are incorporating flex space as a central element of their agile work strategies. JLL “expects 30 percent of all office space globally to be flexible in some form by 2030” (up from about 3% today).

In every industry, technology is an important enabler of not only process efficiency, but also of customer satisfaction and growth, and real estate is no exception (particularly during this pandemic). We’ve already seen technology companies step up to offer useful solutions for landlords and tenants. For instance, companies like Envoy are offering safety-focused tools including employee registration, touchless sign-in, wellness checks and capacity management to employers preparing to re-open their offices. We also expect accelerated adoption of digital solutions related to property and building management, leasing and transaction management. Working on furthering the adoption of technology in real estate? We’d love to talk.

Sorry, the comment form is closed at this time.