Now There Are Four at the Table

We have a fourth player at the publicly traded pure-play residential brokerage poker table – Fathom – and it looks eerily similar to eXp in many ways and strikingly different in other ways. Of the four, Fathom, eXp, and Redfin market themselves as tech-enabled brokers of varying flavors while Realogy continues to roll out technology solutions for its agent base.

Similarities between Fathom and eXp

The founding CEO’s at both firms hold the majority interest in their respective companies. It’s hard to tell at this point if that’s good or bad but now we have two data points in any discussion of future 10-Q’s and 10-K’s. They both also claim to have a nationwide footprint depending on how one defines “nationwide”.

I’d like to say that both could morph into BaaS models but for now Fathom is a 100% agent commission broker while eXp’s operation is a hybrid model in which an agent has to sell probably 6 properties assuming an average selling price of $275K and a 5% broker commission before collecting a 100% commission. Both companies market themselves as cloud-based brokers but as noted further down, technology can’t turn red into black.

Fathom’s S-1 was filed with the apparent intent to offer 13 million shares of its 46.7 million shares and according to this Seeking Alpha article and its S-1, Fathom is looking to raise approximately $14 million in the IPO and “selling shareholders intend to sell up to $1.5 million worth of shares in the offering.” Straight from the cover page and elsewhere in its S-1, Fathom’s projected midpoint price for its IPO is ONE DOLLAR PER SHARE. While eXp’s stock price also started out at around $1, they have survived thanks in part to the inside ownership who have stayed the course for the most part.

Differences Between Them

Unfortunately for Fathom, it had $3.5 million in long-term debt as of last September 30. Contrast that with eXp’s most recent 10-K annual filing in which eXp had about $1.8 million debt on its books. This difference is magnified by the fact that eXp’s revenue rate is at least 10 times that of Fathom so its debt-to-revenue ratio is a small fraction of Fathom’s – a huge difference.

Unfortunately for Fathom, it had $3.5 million in long-term debt as of last September 30. Contrast that with eXp’s most recent 10-K annual filing in which eXp had about $1.8 million debt on its books. This difference is magnified by the fact that eXp’s revenue rate is at least 10 times that of Fathom so its debt-to-revenue ratio is a small fraction of Fathom’s – a huge difference.

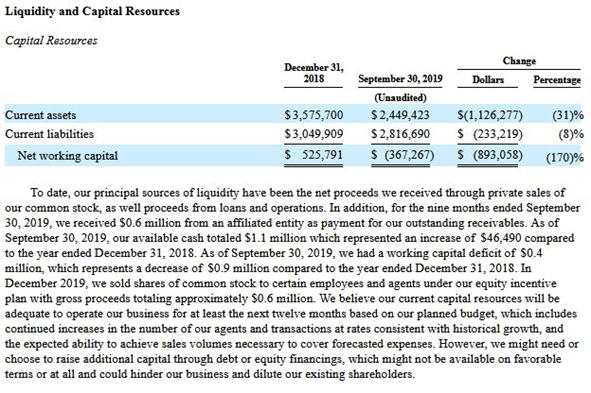

Then there’s this from Fathom’s S-1:

Translated, this means that Fathom has spent a LOT of money on payroll and apparently had to sell over another million shares in a recent private placement to have enough working capital at the end of 2019. Not good. eXp has the same issue with its G&A costs but again, their scale is about 10 times that of Fathom and its stock price definitely looks more attractive to agents and investors than Fathom’s $1 per share.

Looking Ahead

As Fathom will undoubtedly experience at the outset of its publicly traded life, eXp also has the issue of posting net losses quarter after quarter and analysts estimate a loss of $.08 per share. The expectation by some analysts is that increasing scale will eventually bring eXp consistent profitability. Maybe we’ll see that in its next few quarterly reports. For now, eXp needs to get its G&A costs under control or it will burn chips at a rate that will require them to take a loan out to get more chips from the house.

Fathom is basically trying to break into the publicly traded ranks using a branded version of the BaaS model currently being operated by Side. The big difference is that Side has $36 million in VC funding to achieve its vision of a BaaS model while Fathom doesn’t have anywhere near that according to its S-1. Adding it all up, Fathom has few chips and is holding few if any face cards, making for a likely early exit from this table.

What About The Other Two?

Realogy has the scale but also has previously noted problems with its significant debt load and deteriorating commission splits. Even with its announcement of its CRM offering, Realogy is still confronted with the same issues as all the other larger brokers and franchisors who have also invested millions in technology that they say will differentiate them from the competition. Analysts estimate a profit of $.09 per share for Q4 2019, so it looks like Realogy still has face cards to play. Its problem is that it owes the house a lot of money for the chips it is playing with, a debt that is coming due in the near future.

The exemplar of the employee-as-agent business model, Redfin, will report its Q4 numbers on February 13 and analysts are projecting a loss of $.12 per share. Notwithstanding another expected loss as well for Q1 of 2020, Redfin does have a couple cards to play – its version of iBuying and its nascent mortgage origination business. The question there is whether they are face cards, deuces, or somewhere in between. They’ve been betting their chips on technology and nationwide marketing. Another 12-18 months will let us know where they stand.

The irony of all this is that the jury is still out on the long term prospects for all four of them.

The Other Tables in the Room

There are at least four other tables with players at them – the franchisor table, the small broker table, the real estate vendor table, and a table with players best described as brokers who are subsidiaries of publicly traded companies whose primary business is NOT real estate. It’s pretty self-explanatory who sits at these tables although Zillow may switch tables in 2020.

The one that everyone likes to watch, though, is the publicly traded broker table. Bluffs don’t work at this table, all four of them have to show their cards after every hand, and the number of chips being held by each player makes a big difference. The next few 10-Q’s will reveal who wins and who loses at this table.

Sorry, the comment form is closed at this time.